As a statutory CQC (Care Quality Commission) requirement, adequate insurance must be applied to every care home. While standard business insurance might seem to be enough coverage, it lacks the vital protection you need against the specific risks in the care industry.

Employers' liability insurance is required by law for all businesses that employ staff, and public liability insurance is essential if your work involves the public. These, along with professional liability insurance, are the main elements of standard business insurance.

However, despite their effectiveness, they will not provide all the coverage that a care home needs. Each workplace environment will have its unique risks that make choosing the correct liability insurance for your company's legal security essential.

A business should consider whether they might be accused of negligence through a compensation claim from an upset client, for example. Or a member of the public might be injured on their property and seek compensation. A member of your staff may be injured on your worksite and claim compensation as well.

Our extensive experience as insurance brokers in Bolton has shown us that, when a company is looking for business insurance, they must consider the company's working day and what they will need to cover. Simply choosing an average liability plan will leave significant holes in your coverage.

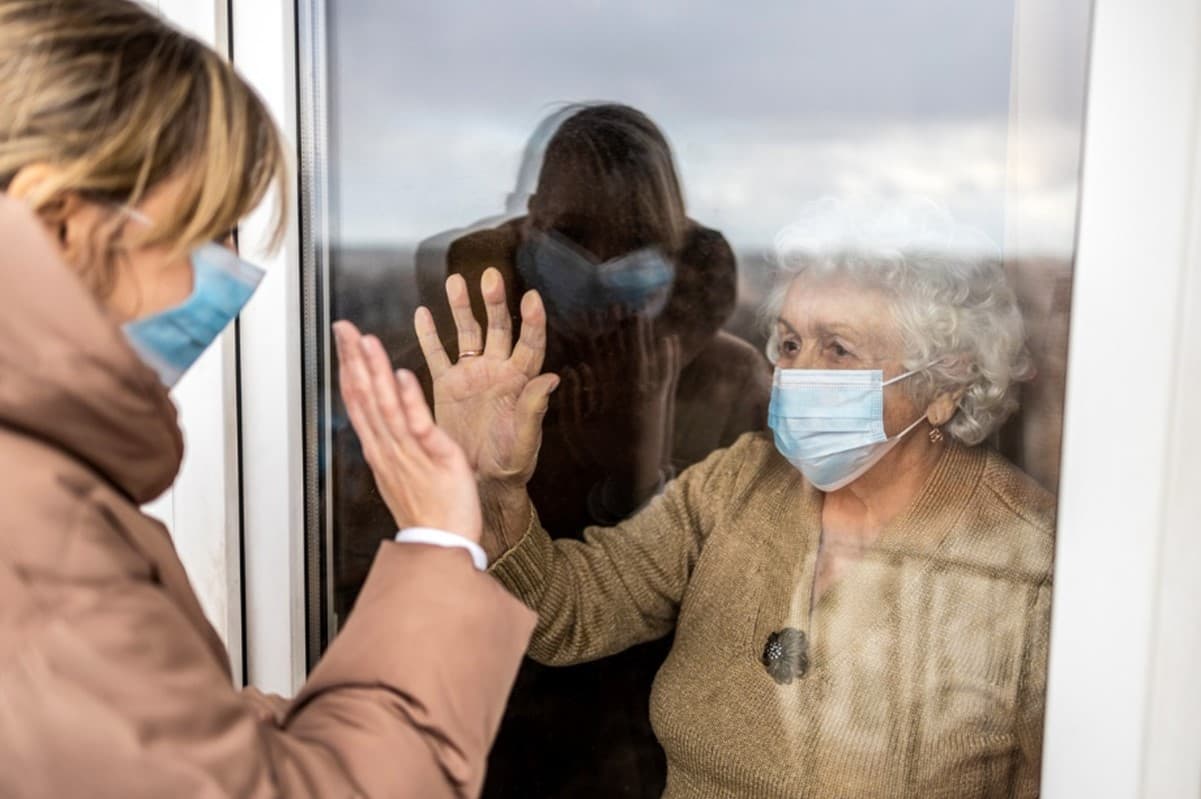

With the unprecedented events of the last two years, care homes have been under more strain than ever before. The frequently changing regulations led to visiting restrictions, which is one of many concerns that created uncertainty around care homes.

The continuing increase of staff shortages is also a big problem for the care industry. The recent announcement by the UK government that there would be mandatory vaccinations for care home staff looks to exacerbate the problem. Up to 12% of care workers are predicted to leave their jobs because of this announcement.

The unfortunate truth is that care work is unfairly undervalued. As one of the lowest-paid occupations in the UK, with one in four earning less than minimum wage, it's easy to see how many workers are leaving their positions with the increased stress of the pandemic.

But the demand for quality care service is rising each year. The UK has a growing ageing population, so there will be a demand for 627,000 extra care staff by 2030. This imbalance in supply and demand is a continuing source of strain for the care sector.

In addition, austerity measures have proved harmful to the care sector. The idea of fixing social care has resulted in a reduction in government funding for these services designed to help the vulnerable.

This decline in staff numbers and reduced budgets have created a noticeable decrease in the quality of service. Whilst children's care has been mostly unaffected by these budget cuts, the adult sectors have suffered.

These three factors combined with the lingering effects of the pandemic have created an environment of heightened risk amongst care homes where there simply isn't enough time and money to prevent every mistake from occurring.

You want to make sure your care home insurance liability gives you total coverage so you can focus on delivering the best care to your residents.

Medical malpractice insurance (or medical indemnity) is a vital protection against accusations of medical malpractice. Care home staff work very long hours, and, even with expertise, mistakes can sometimes happen with severe consequences.

Suppose a member of your team has a claim of malpractice against them for allegedly substandard healthcare. In that case, this medical indemnity is included in our professional indemnity insurance and will provide financial and legal protections, including any costs and fees that may arise from the claim.

It's not just the active care in the home you need to consider either; this is uniquely a place where people work and live. Public liability insurance will help with your resident's visitors, but we also offer a personal effects’ liability.

The residents’ and service users’ personal effects’ liability we offer is the additional cover you need to protect your resident's belongings from theft or property damage.

This liability will give you sufficient coverage for any injury or accident claims associated with products used on your premises. In addition, product liability holds the manufacturers, suppliers and distributors responsible for any injury caused by their products.

Every care home is as unique as the residents living there, and we believe in supplying peace of mind insurance options just as special. With the increased risks each care home faces, let IC Insurance Solutions take some of the strain by providing you with bespoke insurance packages to cover your specific needs.

IC Insurance can do all the hard work for you; call us on 01204 565600 to ask our experts any questions you have about your coverage and get your free quote today.